How has the COVID-19 pandemic impacted the Ontario real estate market?

The Teranet Monthly Market Insights Report presents a snapshot of the overall state of the residential housing market, every month, to provide you insights into mortgage registrations, sales registrations, and more.

The Teranet Monthly Market Insights Report presents a snapshot of the overall state of the residential housing market, every month, to provide you insights into mortgage registrations, sales registrations, and more.

The Market At A Glance

Until April 2020, residential mortgage transactions seemed to be largely unaffected by COVID-19. However, market data from May 2020 showed that the pandemic was beginning to impact the mortgage registration activity as there was a visible decline in the numbers.

The trend continued in June 2020, where there were 41,900 residential mortgage transactions – a decrease from the 45,500 transactions in 2019 and 45,100 transactions in 2018.

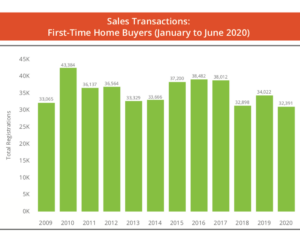

Sales Transaction Activity: First-Time Homebuyers

This month, another key observation was made.

For the first time since 2009, lowest sales transactions were recorded for first-time homebuyers.

In the first half of 2020, first-time homebuyer transaction volumes were 32,391. This number is lesser

than the volume of 32,898 reported in 2018, making it the lowest volume recorded since 2009.

As the mortgage rules were further tightened this month, it will be interesting to see the impact they will have on the mortgage transactions. Canada Mortgage and Housing Corporation (CMHC) announced the following changes for new applications for homeowner transactional and portfolio mortgage insurance:

- Limited the Gross/Total Debt Servicing ratios to 35/42.

- Established a minimum credit score of 680.

- Non-traditional sources of down payment are no longer considered as equity.

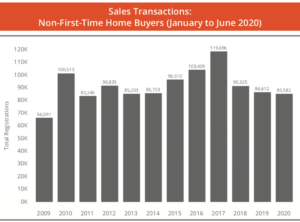

Sales Transaction Activity: Non-First-Time Homebuyers

The non-first-time homebuyer segment reported a transaction volume of 81,572.

This transaction volume was the second lowest volume seen since 2009. It is also important to note that this number has decreased to almost two-thirds of the peak seen in 2017.

When compared to 2018 and 2019, the drop is 9.67% and 8.96% on a year-on-year basis.

Overall, based on the data from June 2020, we can see that the impact of the COVID-19 pandemic is gradually becoming visible across both homebuyer segments.

As more regions across the province continue to open and move towards Stage 3 in the Reopening Ontario plan, it will be interesting to see what trend is observed in mortgage registration volumes over the coming days.

Access the full Teranet Monthly Market Insights Report for free.

Sign up to receive future reports straight to your inbox: https://ci23.actonsoftware.com/acton/fs/blocks/showLandingPage/a/2216/p/p-0065/t/page/fm/0

Stay on top of Canadian real estate trends as the COVID-19 pandemic continues. GeoWarehouse provides up-to-date property data that shows comparable sales, neighbourhood demographics, estimated property value, and beyond.

Not a GeoWarehouse subscriber? Become one today. Call 1-866-237-5937 or visit www.geowarehouse.ca.