GeoWarehouse® is the single source of authoritative property information in Ontario. With the ability to verify ownership, create property detail reports, access to comprehensive neighbourhood sales and various demographics reports, GeoWarehouse subscribers have access to the critical property and land data they need to be successful.

Proven & Trusted

Reporting

GeoWarehouse® is the single source of authoritative property information in Ontario. With the ability to verify ownership, create property detail reports, access to comprehensive neighbourhood sales and various demographics reports, GeoWarehouse subscribers have access to the critical property and land data they need to be successful.

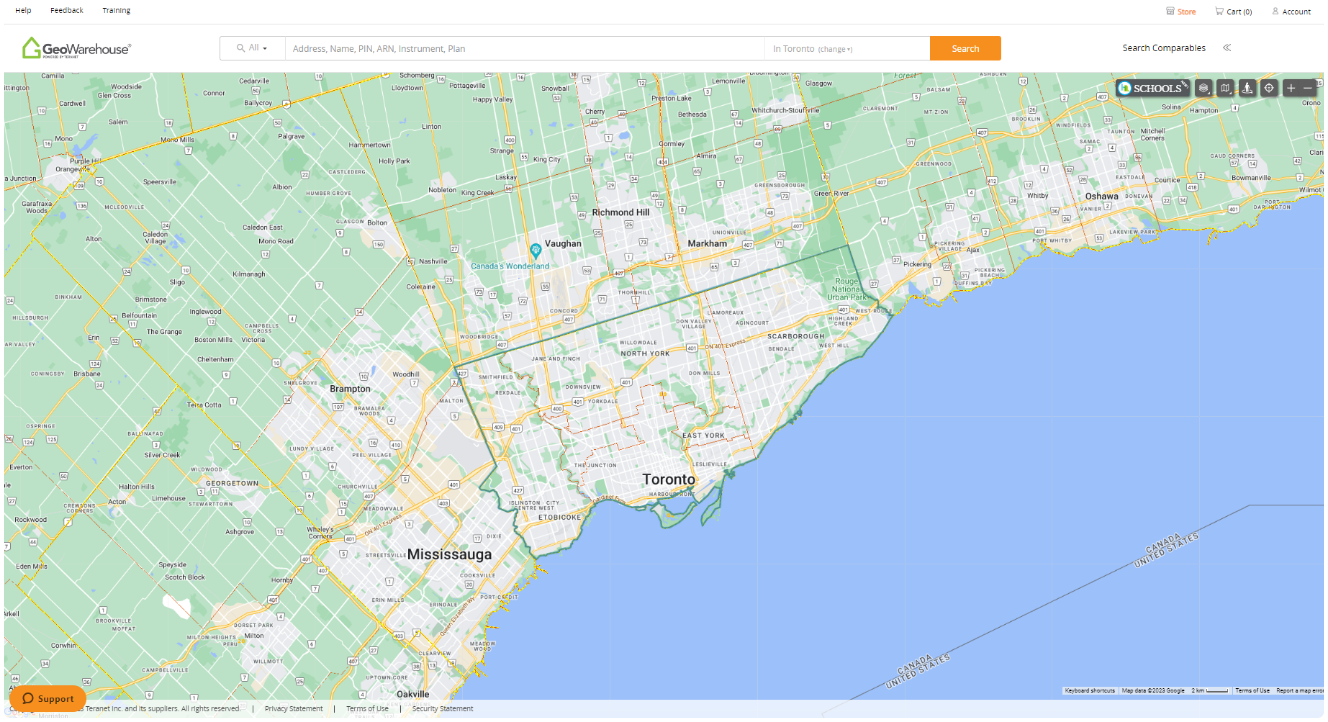

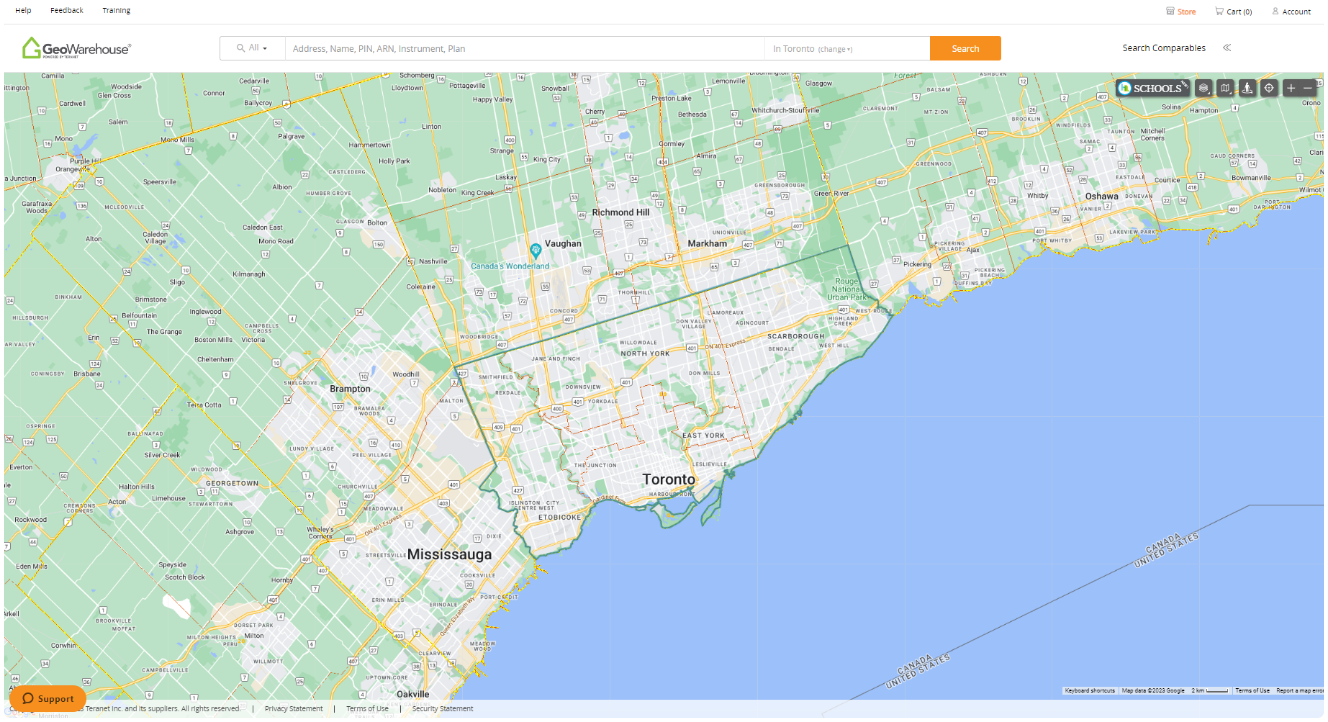

What is GeoWarehouse?

GeoWarehouse is the authoritative web-based centralized property information platform. With its state-of-the-art mapping and complete data source for all real estate transactions, research tools, as well as a range of professional reports, GeoWarehouse revolutionizes the way you access and analyze land and property data in Ontario.

Discover the GeoWarehouse Store, where subscribers can conveniently explore a wealth of resources for purchase to assist with due diligence as all the essential land and property information you need is just a click away.

Equipped with GeoWarehouse, you’ll have the tools at your fingertips to become the go-to expert in your field.

Years in land registration

Properties available for search in Ontario

Canadian users that trust us

Years in land registration

Properties available for search in Ontario

Canadian users that trust us

What is GeoWarehouse?

GeoWarehouse is the authoritative web-based centralized property information platform. With its state-of-the-art mapping and complete data source for all real estate transactions, research tools, as well as a range of professional reports, GeoWarehouse revolutionizes the way you access and analyze land and property data in Ontario.

Discover the GeoWarehouse Store, where subscribers can conveniently explore a wealth of resources for purchase to assist with due diligence as all the essential land and property information you need is just a click away.

Equipped with GeoWarehouse, you’ll have the tools at your fingertips to become the go-to expert in your field.

Years in land registration

Properties available for search in Ontario

Canadian users that trust us

Years in land registration

Properties available for search in Ontario

Canadian users that trust us

Get Access to

Basic Client Report

This report includes an aerial and street view of the property and the details pertaining to the land including lot size.

My Property Report

This all-in-one completely customizable report contains valuable information that includes property ownership and sales history data, imagery of the subject property, estimated market value, and more.

Client Property Report

This customizable report includes private data such as legal description, owner names, market information and comparable sales data. The Client Property Report also includes historical trends, average sales value, market turnover and more.

Comparables Report

This report enables you to review comparable sales in a particular area. You can perform a search by radius, date of sale, and price range.

Interactive Heat Maps

The interactive heat map tool, featuring three layers of data, quickly and accurately displays real estate transaction information for any market in Ontario.

Basic Client Report

This report includes an aerial and street view of the property and the details pertaining to the land including lot size.

My Property Report

This all-in-one completely customizable report contains valuable information that includes property ownership and sales history data, imagery of the subject property, estimated market value, and more.

Client Property Report

This customizable report includes private data such as legal description, owner names, market information and comparable sales data. The Client Property Report also includes historical trends, average sales value, market turnover and more.

Comparables Report

This report enables you to review comparable sales in a particular area. You can perform a search by radius, date of sale, and price range.

Interactive Heat Maps

The interactive heat map tool, featuring three layers of data, quickly and accurately displays real estate transaction information for any market in Ontario.

GeoWarehouse Store

The GeoWarehouse Store is an online store exclusively available to GeoWarehouse customers. It offers professionally packaged reports to help you become the property expert. The GeoWarehouse Store offers a host of products that enable you to perform a comprehensive property search. It is your virtual connection to relevant information such as property ownership history, instrument images, surveys, plans, and other vital data that could make or break your deal.

GeoWarehouse

Store

The GeoWarehouse Store is an online store exclusively available to GeoWarehouse customers. It offers professionally packaged reports to help you become the property expert. The GeoWarehouse Store offers a host of products that enable you to perform a comprehensive property search. It is your virtual connection to relevant information such as property ownership history, instrument images, surveys, plans, and other vital data that could make or break your deal.

Additional Analysis Tools

The following additional reports, available for purchase in the GeoWarehouse Store, provide the insight you need to complete your due diligence.

Additional Analysis Tools

The following additional reports, available for purchase in the GeoWarehouse Store, provide the insight you need to complete your due diligence.

Parcel Register*

This powerful transactional report provides an in-depth look at a property’s history, including ownership, transfers, encumbrances, liens, and more.

Property Insights Report with AVM Range

Access all property information, including a trusted valuation using Teranet’s AVM, helping support CMA development with a secondary unbiased opinion.

Enhanced AVM Comparable Report

This report provides insights into comparable sales in proximity to the subject property, including sales by owner, exclusive sales, builder sales and more.

Residential Relocation Report

The Residential Relocation Reports provide a critical edge, giving you access to migration data within a specific geographic location.

Parcel Register

This powerful transactional report provides an in-depth look at a property’s history, including ownership, transfers, encumbrances, liens, and more.

Property Insights Report with AVM Range

Access all property information, including a trusted valuation using Teranet’s AVM, helping support CMA development with a secondary unbiased opinion.

Enhanced AVM Comparable Report

This report provides insights into comparable sales in proximity to the subject property, including sales by owner, exclusive sales, builder sales and more.

Residential Relocation Report

The Residential Relocation Reports provide a critical edge, giving you access to migration data within a specific geographic location.

GeoWarehouse Success Stories

GeoWarehouse Success Stories

Harness GeoWarehouse to Complete Your Due Diligence

Apply for your GeoWarehouse subscription by completing the form.

Harness GeoWarehouse to Complete Your Due Diligence

Apply for your GeoWarehouse subscription by completing the form.

Our Partners

Our Partners

Explore the GeoWarehouse Blog

Filter

Become an Insighter

At Teranet, we are dedicated to offering you the products and solutions that are beneficial to you in your business. To ensure we are evolving alongside you and your business, we launched the Teranet Insighters Community, which offers you the opportunity to share your voice and valuable feedback.

Help shape the future of our products and services by becoming a member today.

Become an Insighter

At Teranet, we are dedicated to offering you the products and solutions that are beneficial to you in your business. To ensure we are evolving alongside you and your business, we launched the Teranet Insighters Community, which offers you the opportunity to share your voice and valuable feedback.

Help shape the future of our products and services by becoming a member today.