March 18, 2020

In February the Teranet–National Bank National Composite House Price IndexTM was up 0.4% from the previous month, a rise that was double the average of the last 10 Februarys. Component indexes were up for seven of the 11 markets surveyed – Montreal 1.1%, Vancouver 0.8%, Halifax 0.8%, Toronto 0.4%, Victoria 0.2%, Winnipeg 0.1% and Ottawa-Gatineau 0.1%. Indexes were down for Hamilton (−0.3%), Quebec City (−0.4%), Calgary (−0.9%) and Edmonton (−1.3 %).

The index for Vancouver has now gone five months without a decline. Its run of 15 straight months without a rise seems to be definitely over, especially since the Vancouver resale market has returned to balance as measured by its ratio of listings to sales. The index for Victoria has moved little over the last four months. Indexes for Winnipeg, Calgary and Edmonton are down from five months ago. Indexes for Toronto, Montreal, Hamilton and Halifax, on the other hand, are up strongly from 11 months ago. Of the six markets in eastern Canada included in the composite index, Quebec City is the only one that is down from seven months ago.

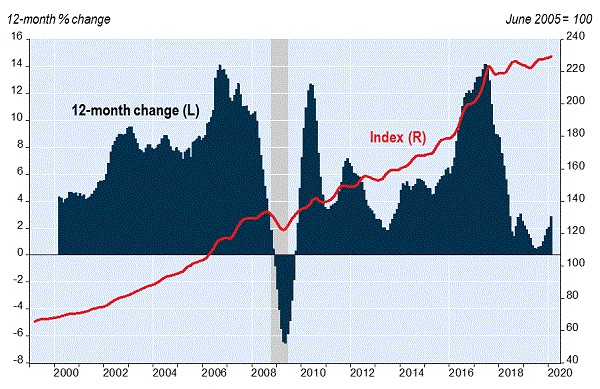

In February the composite index was up 2.9% from a year earlier, a seventh consecutive monthly acceleration of the 12-month gain to its strongest since December 2018. The 12-month rise of the composite index was led by Ottawa-Gatineau (8.7%), Hamilton (8.0%), Montreal (7.5%), Halifax (7.0%) and Toronto (5.1%). Lagging the countrywide average were Victoria (2.5%) and Winnipeg (0.7%). Home prices were down over the 12 months in Quebec City (−0.5%), Calgary (−1.7%), Edmonton (−1.8%) and Vancouver (−2.1%).

Besides the Toronto and Hamilton indexes included in the composite index, indexes exist for the seven other urban areas of the Golden Horseshoe. Some of them started the last 12 months slowly and then surged spectacularly – Brantford, up 7.7% from a year earlier, Kitchener (9.6%) and St. Catharines (8.8%). Conversely, the indexes for Barrie (+4.5%), Guelph (+5.9%), Oshawa (+5.3%) and Peterborough (+7.1%) made most of their gains in the first half of the 12-month period.

Indexes not included in the composite index also exist for seven markets outside the Golden Horseshoe. Of the two in B.C., Abbotsford-Mission has been struggling and its index is down 2.3% from a year earlier, while Kelowna began recovering halfway through the period and in February was up 3.2% from a year earlier. Of the five in Ontario, the index for Thunder Bay declined in February and ended the 12 months with a gain of only 0.6%. Conversely, progress was quite steady in the indexes for Windsor, up 11.5% from a year earlier, London (7.2%) and Kingston (13.4%). Curiously, the 12-month rise of the index for Sudbury was largely concentrated in the month of May.

For the full report, including historical data, please visit www.housepriceindex.ca.