June 17, 2020

In May the Teranet–National Bank National Composite House Price IndexTM was up 1.1% from the previous month, a rise equal to the average for May over the last 10 years. Leading that countrywide average were the metropolitan markets of Ottawa-Gatineau (2.2%), Toronto (2.1%), Halifax (1.8%) and Hamilton (1.6%). Advances lagging the countrywide average were reported for Edmonton (0.9%), Montreal (0.7%), Winnipeg (0.7%) and Quebec City (0.6%). The index for Vancouver was flat on the month. Calgary (−0.2%) and Victoria (−0.5%) were down from the previous month.

A dive beneath the numbers brings up two signs that the underlying data have begun to reflect the slowing of the housing market in the wake of actions taken to stem the spread of Covid-19. First, the number of repeat sales used to derive indexes[1] was down 22% from a year earlier, the largest 12-month decrease since April 2013. This suggests that the slowing of unit sales that began in the second half of March was reflected in the public land registries. Second, the raw composite index[2] for May after correction for seasonal fluctuations (seasonal adjustment) was up only 0.2% on the month, a very marked slowing from the previous three months. The raw index was down or flat in five of the 11 markets of the national composite index.

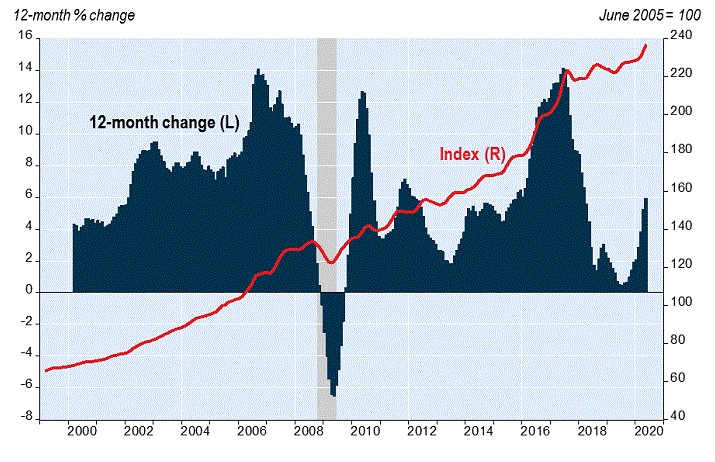

In May the composite index was up 6.0% from a year earlier. It was a 10th consecutive acceleration of the 12-month gain, to its strongest since April 2018. The 12-month rise was led by Ottawa-Gatineau (13.8%), Halifax (10.5%), Toronto (9.7%) Montreal (9.7%) and Hamilton (8.3%). Lagging the countrywide average were Victoria (3.4%), Winnipeg (3.4%) and Vancouver (0.7%). Deflating over the 12 months were Quebec City (−0.2%), Calgary (−1.3%) and Edmonton (−1.7%).

Besides the Toronto and Hamilton indexes included in the composite index, indexes exist for the seven other urban areas of the Golden Horseshoe. In May the number of repeat sales was down in six of them, by more than 30% in the Peterborough and St. Catharines markets. The table below presents the monthly and 12-month changes of the smoothed indexes for these markets. The raw indexes of Barrie, Guelph, Kitchener and Peterborough were down in May. Those for Brantford, St. Catharines and Oshawa were not.

Indexes not included in the composite index also exist for seven markets outside the Golden Horseshoe. Of the two in B.C., repeat sales were down sharply in both Abbotsford-Mission and Kelowna and the seasonally adjusted raw index was down for Abbotsford-Mission. Repeat sales were also down sharply in all of the five in Ontario – London, Kingston, Windsor, Thunder Bay and Sudbury. The seasonally adjusted raw indexes were down for Sudbury, Windsor and London.

For the full report, including historical data, please visit www.housepriceindex.ca.